Numbers are in and Indiana government had a budget surplus from their 2015 Continue reading →

Tag / Taxes

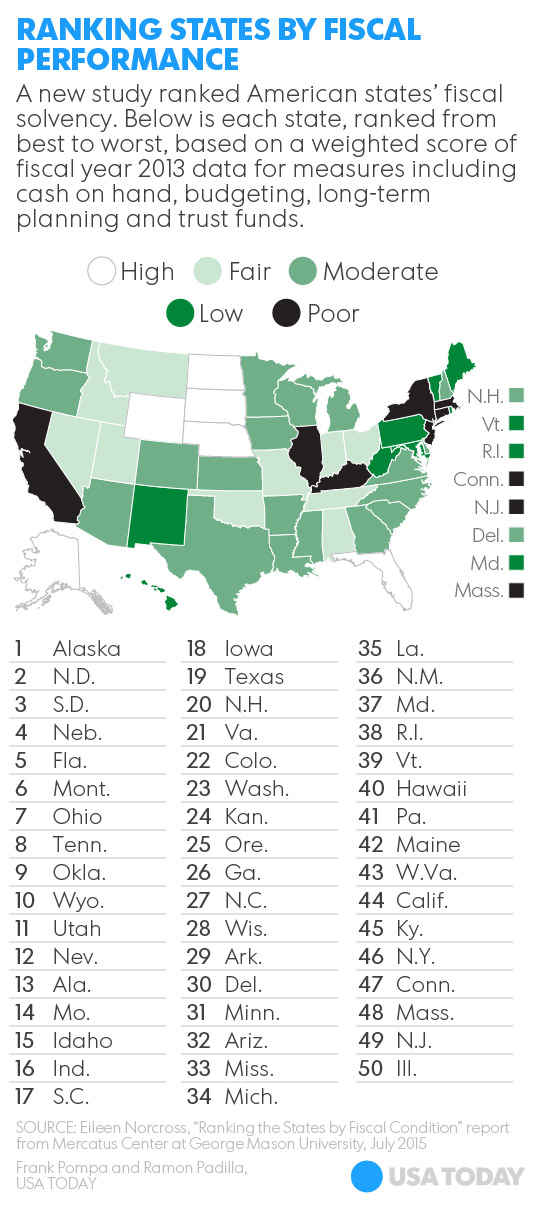

Indiana Ranked 16th on Fiscal Solvency

Via USA Today –

The Mercatus Center, a public policy research group, ranked the 50 states based on how well each state government planned spending in fiscal 2013 — the most recent year for which data was available — as well as their future financial prospects. from annual budgeting to cash to pay bills, to funding for pensions and long-term plans.

Chicago: Hey, Lets Tax Netflix

Courtesy http://www.frugal-cafe.com

The financial stress of the City of Chicago financial obligations is growing. This week Continue reading →

Indiana Taxpayers To Become Biggest Supporter of Indianapolis Motor Speedway

The Indianapolis Motor Speedway and Indiana taxpayers officially become one starting next week when Continue reading →

U.S. Government Debt Getting Worse

Via The Washington Examiner –

Continue reading →

Example of Why Healthcare Is Expensive

Average Obamacare Tax is $1130

Back in 2009 when President Obama repeated that the Obamacare mandate was not a tax.

Today, more Obamacare information keeps rolling out showing the fees or what the U.S. Supreme Court labeled a “tax”. Here is a brief excerpt from Forbes.com:

As millions of Americans scramble to file their tax returns, many are shocked by the full cost of ObamaCare’s individual mandate.

“Those who failed to obtain minimum essential health insurance coverage last year will have had to send the Internal Revenue Service (IRS) a check for $1,130, on average,” Doug Holtz-Eakin, former director of the Congressional Budget Office, testified today before a congressional hearing.

You can read the rest here.

Study: People Are Leaving High-Tax States

Washington Times and Stephen Moore put together a piece showing migration out of high tax states and migration into low tax states.

The least “regressive” tax states had average population growth from 2003 to 2013 that lagged below the national trend. The 10 most highly “regressive” tax states, including nine with no state income tax, had population growth on average 4 percent above the U.S. average. Why was that? Because states without income taxes have twice the job growth of states with high tax rates. Unlike the experts at the Institute on Taxation and Economic Policy, most Americans think that fairness means having a job.

Read the rest here.

Obamacare Total Page Count on IRS Website

Researchers at the National Taxpayers Union Foundation did a study on lost productivity in America due to our tax code. Washington Times published an article on it entitled “U.S. economy out $233.8 billion due to ‘lost productivity’ as Americans wrestle with taxes: Study”

An interesting number was in the study concerning the amount of pages Obamacare takes up on the IRS website:

the researchers also found a “staggering” 3,322 pages of legal guidance for the Affordable Care Act at the IRS website. The content includes regulations, Treasury decisions, assorted notices, revenue procedures, and revenue rulings.

As far as the study of our tax code, here are some sad numbers:

The study also notes that the estimated length of the Tax Code itself is about 4 million words. The study grimly recalls that the Form 1040 instructions were once just two pages long. “Today, taxpayers must wade through 209 pages of instructions, quadruple the number in 1985, the year before taxes were simplified,” it states.

2015 Medicaid Spending Up 21%

The numbers are staggering in how fast medicaid is growing and spending. This isn’t a sexy topic to talk about but that is the psychosis of America’s political landscape today. Here is some recent news pertaining to this federal government social program.

Via Wall Street Journal –

-

Medicaid enrollment has surged 19% nationally since ObamaCare’s expansion—50% in New Mexico, 65% in Oregon, 81% in Kentucky. The Congressional Budget Office reports that Medicaid spending rose 21% in the first five months of fiscal year 2015, “largely because of” ObamaCare.

Another source, The Heritage Foundation added more data to the topic of medicaid growth –

-

This jump does not even include the Obamacare insurance exchange subsidies that are now in place—a $7 billion increase so far this year. Medicaid and the Obamacare subsidies account for $28 billion of the $88 billion in mandatory spending increases this year. The extent to which growth of Obamacare and other entitlements is responsible for this increase is even more pronounced than at first glance. Leaving GSEs out of the equation, increases in Medicaid and Obamacare subsidies accounted for half of the mandatory spending increase so far this year. Meanwhile, defense spending is down nearly 5 percent.

One more item from Heritage is the overall growth of entitlement spending.

-

Chart 12 shows the growth of more than 80 welfare programs since 2007—including food stamps, unemployment insurance, housing aid, Medicaid, and disability payments. Some of these increases were results of the recession, while others were due to Obama policies that expanded eligibility and cancelled work requirements. Since 2008, spending has soared 37.2 percent in these programs. Since 2007, spending has mushroomed nearly 55 percent