ObamaCare ads will now appear on 7-Eleven receipts at more than 7,000 stores nationwide as government health officials expand their outreach in the second year of healthcare sign-ups.

Information about ObamaCare sign-ups will appear on the bottom of receipts for anyone using a mobile payment company called PayNearMe, which allows bank-less customers to pay in stores like 7-Eleven and Family Dollar.

Health and Human Services (HHS) Secretary Sylvia Mathews Burwell announced the new partnership with the tech start-up PayNearMe on Thursday at a store in Washington, D.C.

“Putting these reminders at the bottom of PayNearMe receipts will help get health coverage information into the hands of traditionally hard-to-reach consumers,” HHS wrote in a statement.

The partnership will help HHS “reach financially underserved and other cash-preferring consumers,” the statement reads.

Month / December 2014

NASCAR Fan Base is Shrinking

SportingNews.com has come out with a report showing the sad state of affairs for auto racing. Here are the somber numbers:

Alterations announced this week are in line with a trend of tracks removing seats. Charlotte, after removing 41,000 seats this winter, will be down to permanent seating of 89,000 in 2015, a startlingly low capacity considering its location in NASCAR’s epicenter.

But it’s par for the course. Atlanta is removing 17,000 seats to get down to 75,000; Dover is removing 17,500 seats to get down to 95,500; and Daytona is removing its backstretch grandstands of 46,500 next spring to go to 101,500 seats.

In 2013 alone, the following ISC tracks cut seats: Talladega (from 108,000 to 78,000), Richmond (91,000 to 71,000), Chicagoland (69,000 to 55,500), Michigan (84,000 to 71,000), California (81,000 to 68,000), Darlington (60,000 to 58,000) and Homestead (56,000 to 46,000). Any additional cuts likely will be revealed when its annual report comes out in January.

This is a very loaded story. You can read the rest here.

Federal Government Deficit for 2015 Fiscal Year

CNSNews.com is reporting the federal governments 2015 first two fiscal months of tax revenue collected and how much it spent.

The U.S. Treasury continued to rake in tax dollars at a record rate in November as the federal government closed out the first two months of fiscal 2015 with $404,155,000,000 in total receipts, according to the Monthly Treasury Statement released today.

Even with these record revenues, the Treasury ran a deficit of $178.531 billion deficit in October and November as it spent $582.686 billion.

What were the sources of revenue?

The biggest source for the record federal revenue during the two-month period was the individual income tax. It brought in $192,619,000,000 in October and November. The second biggest source was “Social Insurance and Retirement Receipts,” the taxes Americans pay for Social Security and Medicare. These brought in $146,263,000,000.

How the Wealthy Write Off Taxes

Whenever I see someone famous on TV talking about the need for higher taxes or claiming they enjoy paying taxes I always say, “Their accountant is laughing”.

Senator Tom Coburn issued a report showing exactly what I mean.

The tax code is so peppered with special giveaways that companies such as Facebook end up getting refunds, and high-profile athletes and artists use their tax-free foundations to give friends jobs while avoiding taxes — all leading to higher income tax rates for the rest of us, Sen. Tom Coburn charges in a new report being released Tuesday.

Here is a snapshot of what was found by his staff:

-Baseball owners are able to claim their players “depreciate” over time, the same way farms are able to claim their tractors depreciate

– Athletes and Hollywood stars who form tax-exempt organizations that they then use as tax shelters, throwing parties or paying employees’ salaries from the tax-exempt accounts while dedicating almost no money to charitable works.

-Kanye West’s foundation spent more than $1 million in 2009 and 2010 but “gave virtually nothing” to charity. Fellow performer Lady Gaga’s Born This Way Foundation raised $2.6 million but only gave away $5,000 in grants

You can read more via Washington Times

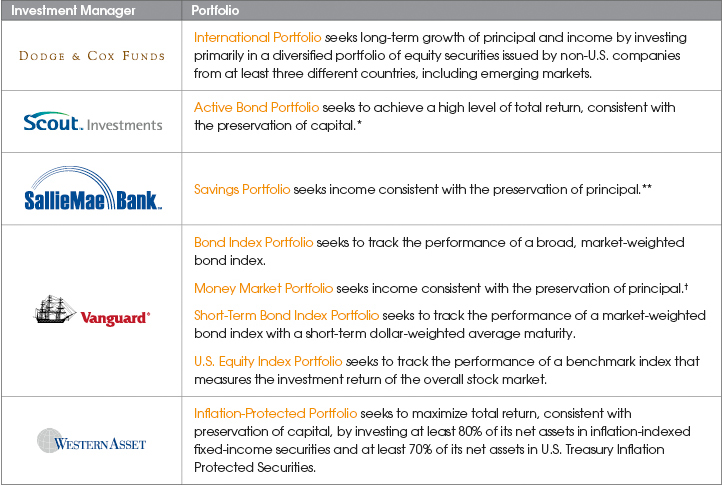

Is the Indiana 529 College Choice Plan Worth It?

For many months now I’ve been hearing and seeing commercials for a program geared towards parents that helps them save for college. The program is called the COLLEGE CHOICE 529 INVESTMENT PLAN. Per Indiana Department of Education website:

The program allows Hoosiers to plan for their children’s or loved one’s future, making contributions into an investment account for higher education expenses. Indiana also enacted a tax credit that makes the CollegeChoice Plan an even better option.

You are directed out of the state website and to a place called College Choice Advisor. To be very brief, this is the site where you sign up an account and it gives you investment options for saving /giving. That is the key component of why I think a program like this is unnecessary…..investing. Parents can easily do this on their own with more options. This website really doesn’t offer a variety like you could get with a local advisor or you’re own research.

The investing assumptions they provide are very broad and unrealistic in today’s income reality a lot of people are living in. Per the website:

If an investor opened a 529 account with an initial investment of $2,500 and contributed $100 every month for 18 years, there could be over $6,300 more for a qualified withdrawal than the same investment in a taxable account.*

There is a reason for an asterisk at the end of that statement:

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only.

That is a big assumption. Going back to a recent comment is my philosophy of having many ranges of investment choices. The 529 doesn’t really offer much:

Overall the 529 is a plan that allows people to throw their money in a fund and than forget about it. I think parents should be more hands on with their money they save which then leads to conversations about money responsibility.

The majority of parents will never to be able to fully fund their children’s college and their’s nothing wrong with that. Big percentage of children will not attend or finish college at all. No one knows what college will be like 20 years down the road in a traditional sense. Save wisely for helping your child in college or with something else they may strive for. Just don’t hand it over to investors to draw a 1% fee for 18 years because it sounds good.

Lawyers Getting Rich Off Social Security Disability

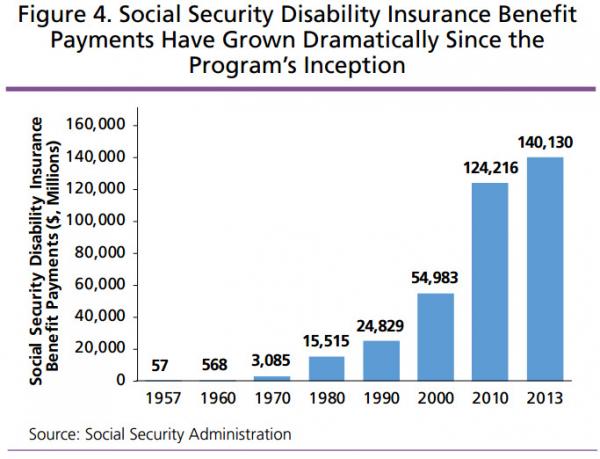

ZeroHedge.com is out today with a piece about the explosion of social security disability and what lawyers are getting in fees.

Here is a snippet and you can read the rest here.

Social Security Disability Insurance (SSDI) is no small program, costing taxpayers more than the combined cost of federal welfare payments, housing subsidies, food stamps and school lunches. Attorneys receive taxpayer-funded fees each time they successfully place a client in the program, which incentivizes them to encourage clients to file disability claims. The fees are capped at 25 percent of the successful client’s SSDI award, or $6,000, whichever is less.

Attorneys took in $1.2 billion in such fees in 2013, up from just $425 million in 2011.

Here is a graph showing the explosion of SSDI recepients.

Economics & “Coolidge”

Halfway through reading Amity Shlaes book “Coolidge”. Very detailed and good reference for what the country was politically/economically facing at the time. Here are some economic factors from Calvin Coolidge time period:

Debt after WWI was $27 Billion. Nine times higher than 2 years before.

College professor salaries in 1890 were $2,500. This was 20 times more then tuition. Average American wage earner made $425/year.

1905, home in Massachusetts cost between $2,000-$5,000. Banks did not do mortgages. Building associations did.

1915 IRS employed 4700 people

1920 federal budget was $6.3 Billion and Calvin Coolidge Vice Presidential salary was $12,000.

From 1920 – 1921 Ford Motor Company sold 1.25 million cars.

Graph of the Day: College Liberal Art Degrees Becoming Unnecessary

Wind and Solar Carry Higher Megawatt Prices

Economic Policies for the 21st Century recently published a lengthy article titled America Should Avoid Germany’s Failed Energy Policy. Found an interesting price comparison of renewable energy vs standard forms.

These problems with green energy help to explain why only 4 percent of U.S. energy comes from wind and solar. Data from the Energy Information Agency show that, for plants entering service in 2019, levelized wind power costs will be between $64 and $175 per megawatt. Solar power will cost between $155 and $195 per megawatt. For comparison, conventional natural gas fired plants produce energy at a levelized cost of $14 per megawatt. Nuclear comes in at $71 per megawatt, comparable with efficient wind farms. The costs to consumers from renewable energy mandates are even higher when tax incentives are included.

Cost of Caring for Illegal Immigrant Child: $86,846.34

While back I posted a piece about the cost associated with the taxpayer caring for illegal immigrant children. Now new dollar amounts have been discovered by Judicial Watch. Sad thing about the bloviating transparency talk from immigrant supporters is this information had to be obtained by an FOIA because the government was unwilling to produce the numbers.

Federal officials paid Baptist Children and Family Services nearly $183 million to help care for 2,400 unaccompanied illegal immigrant children for four months earlier this year at military facilities in Oklahoma and Texas, according to documents made public Wednesday by Judicial Watch.

“The cost to the American taxpayer was $86,846.34 per illegal alien child at Ft. Sill [in Oklahoma], for a total to $104,215,608 for 1,200 UACs from June 12 to October 18,” Judicial Watch said. “The bill also included $2,648,800 in compensation for 30 members of the BCFS ‘Incident Management Team,’ for a total to $88,293 per IMT member for the four-month period.”

The contract was awarded to Baptist Children and Family Services. Here are other items bought by this contract:

“Recreational items will include board games, soccer balls, basket balls, jump ropes, bracelet making kits, yarn, puzzles, arts and crafts, decks of cards, and eye-hand coordination game sets. Reimbursement is requested for $180,000.”

“Educational items will include … tempera paint, paint markers, paint brushes, easel brushes, art paper … Crayons, multicultural crayons … for $180,000.”

“Laptop Kits … 100 Kits … 5 Laptops per kit – $500 per kit … $200,000.”

°“VOIP Phone Kits … 80 kits … 10 cell phones per kit with International call capabilities and radio … $160,000”

H/T Washington Times