For many months now I’ve been hearing and seeing commercials for a program geared towards parents that helps them save for college. The program is called the COLLEGE CHOICE 529 INVESTMENT PLAN. Per Indiana Department of Education website:

The program allows Hoosiers to plan for their children’s or loved one’s future, making contributions into an investment account for higher education expenses. Indiana also enacted a tax credit that makes the CollegeChoice Plan an even better option.

You are directed out of the state website and to a place called College Choice Advisor. To be very brief, this is the site where you sign up an account and it gives you investment options for saving /giving. That is the key component of why I think a program like this is unnecessary…..investing. Parents can easily do this on their own with more options. This website really doesn’t offer a variety like you could get with a local advisor or you’re own research.

The investing assumptions they provide are very broad and unrealistic in today’s income reality a lot of people are living in. Per the website:

If an investor opened a 529 account with an initial investment of $2,500 and contributed $100 every month for 18 years, there could be over $6,300 more for a qualified withdrawal than the same investment in a taxable account.*

There is a reason for an asterisk at the end of that statement:

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only.

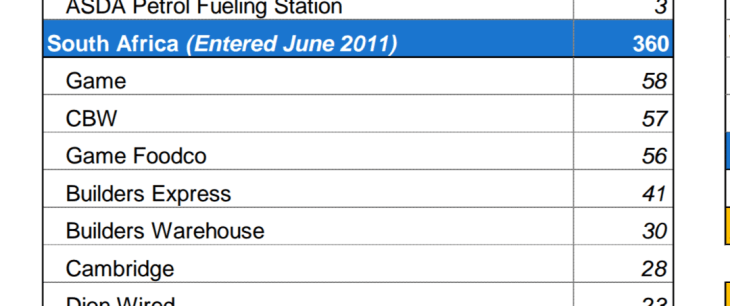

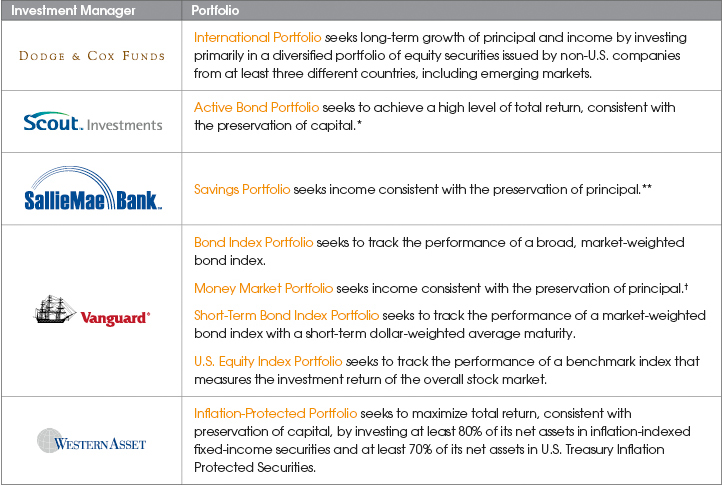

That is a big assumption. Going back to a recent comment is my philosophy of having many ranges of investment choices. The 529 doesn’t really offer much:

Overall the 529 is a plan that allows people to throw their money in a fund and than forget about it. I think parents should be more hands on with their money they save which then leads to conversations about money responsibility.

The majority of parents will never to be able to fully fund their children’s college and their’s nothing wrong with that. Big percentage of children will not attend or finish college at all. No one knows what college will be like 20 years down the road in a traditional sense. Save wisely for helping your child in college or with something else they may strive for. Just don’t hand it over to investors to draw a 1% fee for 18 years because it sounds good.