This blog has chronicled how lawyers get rich taking in Social Security Disability claims.

Now CNSNews has come out with some new SS disability data that raises some doubt if this program has any control:

One in three, or 35.2 percent, of people getting federal disability insurance benefits have been diagnosed with a mental disorder, according to the latest data from the Social Security Administration (SSA).

Washington, D.C., the seat of the federal government, ranked in the top-ten list of states where disabled beneficiaries were diagnosed with mental problems.

In 2013, the latest data from SSA show there were 10,228,364 disabled beneficiaries, up 139,625 from 2012 when there were 10,088,739 disabled beneficiaries.

Disabled beneficiaries have increased 49.7 percent from a decade ago in 2003 when there were 6,830,714 beneficiaries; and the number is up 14.3 percent from the 8,945,376 beneficiaries in 2009, the year President Obama took office.

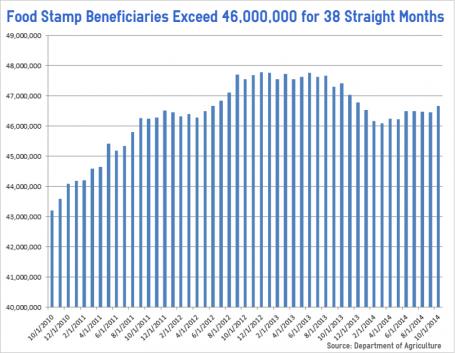

Here is another chart showing how big the disability fund has grown in the last ten years.